Delivered a fully remote financial close in 120 countries.

Seamlessly manage accounting, tax, and reporting across borders – with customers in 175+ countries, Workday Financial Management simplifies your global business.

Our financial management foundation provides accurate and auditable information, process standardisation, and the global visibility you need to meet international rules and unique requirements.

Multi-GAAP

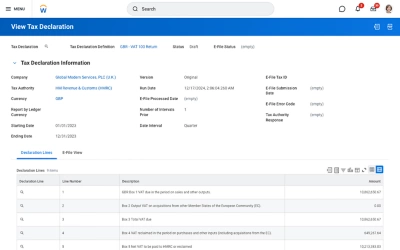

Global tax reporting framework

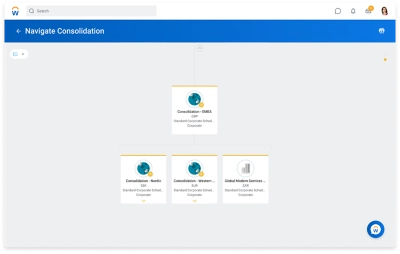

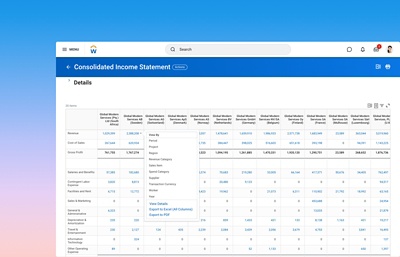

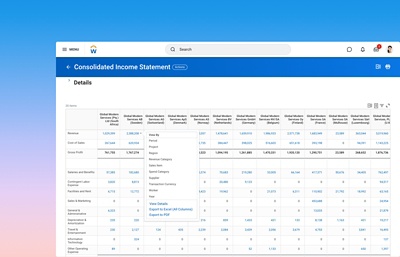

Global consolidation

E-Invoicing Connector

Every country has unique financial rules and requirements. That’s why Workday offers built-in flexibility to adapt to regional regulations and accounting standards – no customisations needed.

A consistent user experience

Create a consistent experience worldwide – Workday Financial Management is available in 15 languages and supports global time zones, currencies, address formats and more.

Flexible frameworks to meet local requirements.

Support multiple charts of accounts and books; various tax, banking and payment formats; and more – without customisation. Workday is HMRC recognised accounting software, giving you confidence in being fully compatible with Making Tax Digital (MTD).

Built to deploy faster

With 55 prebuilt and country-specific configurations – including tax rates and rules, invoice formats and localized reports – you have what you need to get started fast.

“We needed to move to a platform that could scale up easily but also a system that could be used worldwide. It’s essential for the business, certainly for the management board, to make quick decisions based on accurate information – and that all comes from Workday.”

– Robert Jan Wassink, Vice President Group Finance, Just Eat Takeaway.com

Global tax and compliance, perfected

Our tax framework supports global transaction and withholding tax requirements and simplifies reporting to ensure compliance.

Centralised tax controls

Automate tax determination, calculation and declaration for complete transparency and control leveraging rule-based workflows.

Streamlined tax reporting

Generate tax reports in compliance with local regulatory standards and maintain a full audit trail of all tax-related activities.

Shared data models and reporting across geographies help you easily adapt to changes such as M&A or global expansion.

Streamline workflows and allow for local changes – we help you enforce controls globally while meeting local requirements.

Centralise global accounting processes for a faster close and simplified shared service centre operations.

Easily consolidate financial results in any currency with real-time eliminations and translations.