ACCOUNTING

Turn accounting into a strategic powerhouse

Workday uses AI to help accounting teams boost productivity, uncover sharper insights and build confidence in every number.

WHAT YOU CAN DO

Save time and drive value with AI

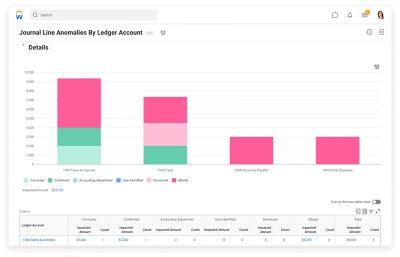

Workday Illuminate™, our next-gen AI, continuously detects anomalies, identifies exceptions and provides smart recommendations across all your accounting and finance processes.

And our AI agents take your insights even further – driving faster results, improving accuracy and reducing manual effort everywhere.

-

General ledger

-

Accounts payable and receivable

-

Fixed-asset management

-

Revenue and cash management

-

Global consolidation and reporting

-

Revenue Contract Agent

-

Financial Test Suite

Accounting Agents

AI agents for accounting

Unlock hidden potential with Revenue Contract Agent

Turn every document into a strategic asset. Automatically extract and analyse contract data for greater accuracy and less manual effort, and surface key insights to drive decision-making.

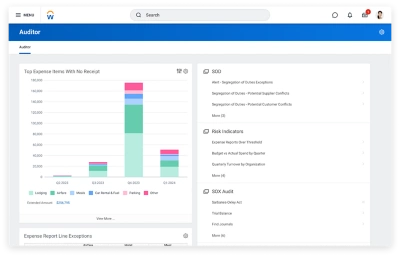

Elevate financial assurance and accelerate audit readiness with the Financial Test Suite

Financial Test Suite provides a greater level of scrutiny over financial data, identifies and resolves anomalies, and accelerates audit evidence collection. Our agent builds confidence, improves data quality and streamlines audits.

Boost productivity with AI-powered automation

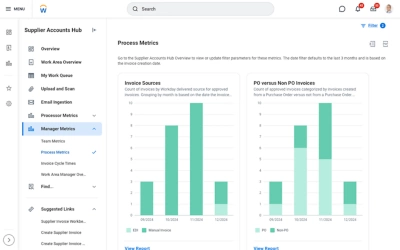

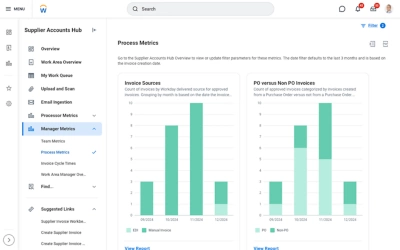

Pay suppliers with ease

Automation for accounts payable uses agentic AI to streamline invoice processing and inbox management, boosting accuracy and control while saving time.

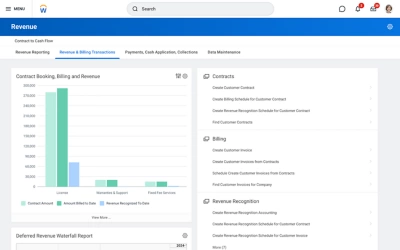

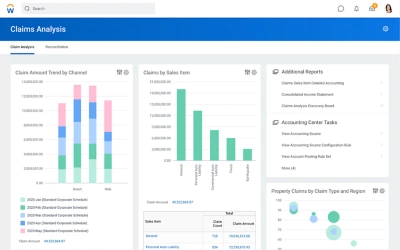

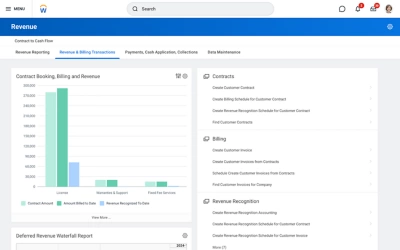

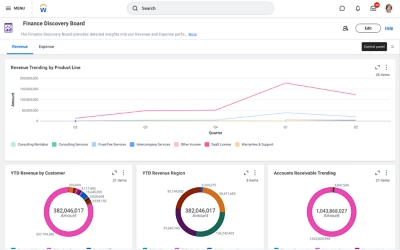

Unify revenue at every stage

Opportunity-to-cash connects sales, finance and operations to streamline the entire revenue lifecycle, driving precision from opportunity to recognition faster than ever.

Turn operational data into accounting

Workday Accounting Centre automatically transforms operational data into accounting – accelerating close cycles and giving your team more time to focus on analysis and action.

Work at the speed of business

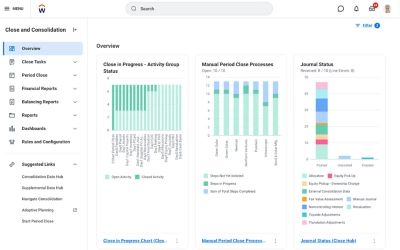

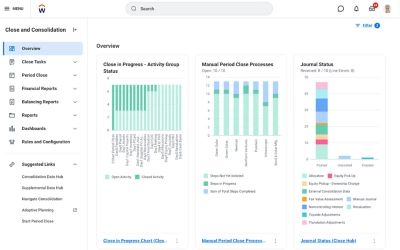

Continuous accounting keeps pace with your business, giving your team real-time insights into the close and smart context that drives more confident decisions.

Pay suppliers with ease

Automation for accounts payable uses agentic AI to streamline invoice processing and inbox management, boosting accuracy and control while saving time.

Unify revenue at every stage

Opportunity-to-cash connects sales, finance and operations to streamline the entire revenue lifecycle, driving precision from opportunity to recognition faster than ever.

Turn operational data into accounting

Workday Accounting Centre automatically transforms operational data into accounting – accelerating close cycles and giving your team more time to focus on analysis and action.

Work at the speed of business

Continuous accounting keeps pace with your business, giving your team real-time insights into the close and smart context that drives more confident decisions.

“The automation we’ve put in place and the efficiencies we’ve gained because we have all this data in one location has been tremendous for our team.”

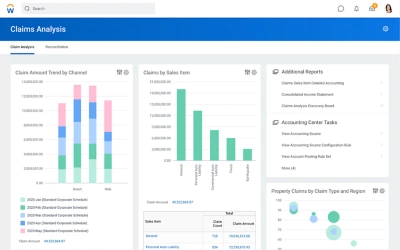

Continuous auditing for peace of mind

Always-on audit lets you configure workflows for every process and transaction, set standardised controls and track changes in real time – saving your business both time and money.

Accelerate time to action with data-driven decisions

Continuous accounting for in-the-moment insight

See the impact of your transactions as they happen with continuous accounting. And quickly identify and address issues for easier analysis.

Assess the financial impact of business events

Workday transforms operational transactions into detailed accounting so you can see your full financial picture all in one place.

Consolidate in real time for a faster close

Why wait for period-end to view results? Automatically create accounting in real time for an in-the-moment view into consolidated financial performance.

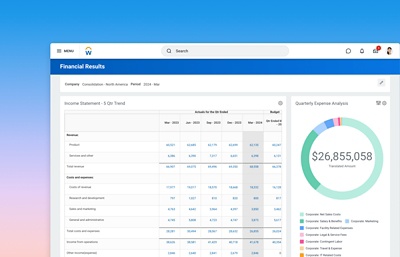

Multidimensional analysis from any report

Analyse transactions and accounting, compare budget versus actuals, and blend financial and operational data – all in the same system.

Drill into your data and share results

Unite data from any source for a more comprehensive analysis – and when it’s time to report, quickly produce financial statements, KPIs, scorecards and more.

Turn your data into action

Workday Illuminate™ optimises finance processes – freeing your team to be more strategic. By shifting from value tracker to value creator you can boost efficiency, accuracy and insights while driving smarter decisions across your business.

A Leader in Gartner® Magic Quadrant™ for Cloud ERP for Service-Centric Enterprises

Voice of the Customer for Cloud ERP for Service-Centric Enterprises

A consistent source of truth for FP&A and accounting.

With a seamless flow of information, FP&A gains immediate access to actuals, empowering more continuous planning. And accounting can understand performance relative to budget at all times.

See how we help you succeed