Revenue Management Software

Seamless revenue management, from opportunity to cash.

what you can do

End-to-end revenue management.

Workday Revenue Management takes care of the entire revenue lifecycle.

And as your business needs evolve, our revenue management software delivers the flexibility and scalability you need to adapt to changing business requirements and reach growth goals.

-

Opportunity-to-cash processing

-

ASC 606/IFRS 15 compliance

-

Profitability reporting

-

Project billing

-

Customer management

-

Automated intercompany transfers

Workday ranked #1 in Automated Revenue Management for 2022.

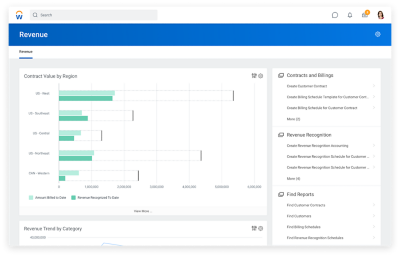

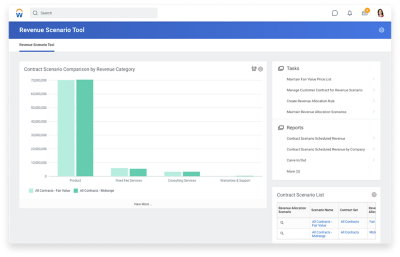

Comprehensive revenue recognition.

Workday gives you the flexibility to support complex revenue arrangements while complying with GAAP and IFRS guidelines. You can also run what-if scenarios to see how they’ll impact your business.

-

Record revenue events

-

Complete fair-value analysis

-

Link contracts

-

Recognize many revenue arrangements

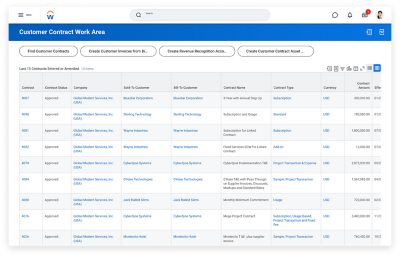

Complete visibility. Flexible features. A global core.

Our revenue management system lets you view, adjust, and analyze everything in one system built on a robust global core.

Create, approve, and track customers across the life of every contract—capturing every contractual change for greater visibility and lower risk.

Choose from a wide range of billing models and gain deeper insight into markups, write-offs, and billing rules to reduce revenue leakage.

Automatically create intercompany invoices to cross-charge projects, promote accuracy, assess profitability, and align revenue with cost.

See how we get

you live fast.