The Coventry has gone from manual processes to slicing and dicing data in the UK.

The key to driving your business forward? One powerful AI platform that keeps your most important assets on track, every decision on point, and your fleet of AI agents at peak performance. That’s Workday.

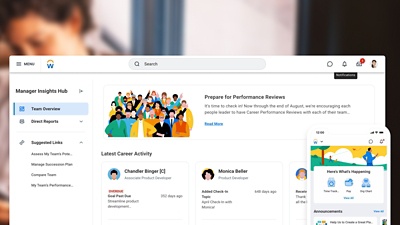

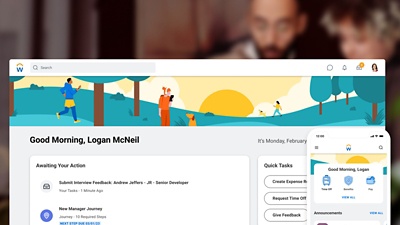

Human Capital Management

Elevate the potential of your people, boost productivity with AI, and unify your human and agent workforce.

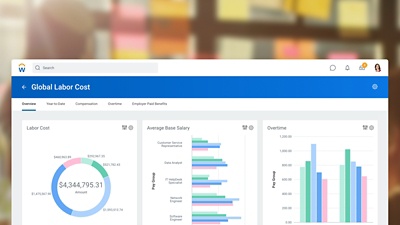

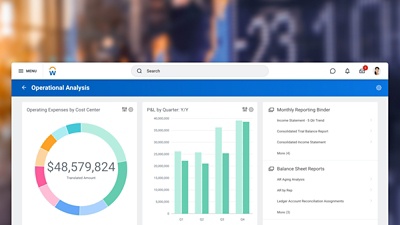

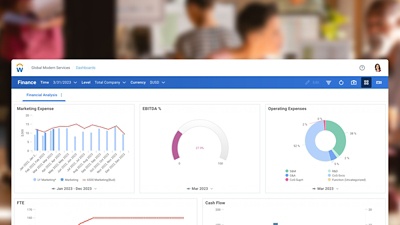

Financial Management

Use AI-generated insights to manage costs and make finance decisions with confidence.

Rock Stars of Business

Our favorite rock stars are back—and they have some thoughts on AI agents.

“Workday transforms the way finance works by unlocking insights rather than processing data. I feel so privileged to deliver technology that makes people’s lives better.”

Elevate humans.

Free your people up to focus on more meaningful work that only humans can do.

Supercharge work.

Do more with less to drive flawless business operations that save time, money, and effort.

Workday Illuminate™.

Deliver measurable value with an AI platform that illuminates the future of work.

Forward thinkers. Inspiring results.

Human Capital Management

Manage your people and your processes in one place.

Payroll

Streamline payroll, HR, and time management with a unified solution.

Employee Experience

Deliver personalised experiences that keep your people primed to perform.

“Workday transforms the way finance works by unlocking insights rather than processing data. I feel so privileged to deliver technology that makes people’s lives better.”

Elevate humans.

Free your people up to focus on more meaningful work that only humans can do.

Supercharge work.

Do more with less to drive flawless business operations that save time, money, and effort.

Workday Illuminate™.

Deliver measurable value with an AI platform that illuminates the future of work.

Forward thinkers. Inspiring results.

Financial Management

Move from tracking value to creating value.

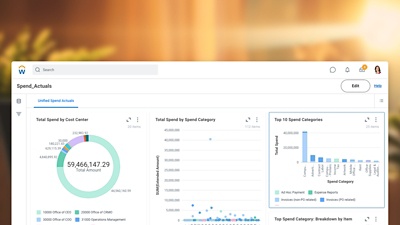

Spend Management

Gain visibility into the entire source-to-pay process.

Financial Planning

Move faster with continuous, collaborative planning.

“Workday transforms the way finance works by unlocking insights rather than processing data. I feel so privileged to deliver technology that makes people’s lives better.”

Elevate humans.

Free your people up to focus on more meaningful work that only humans can do.

Supercharge work.

Do more with less to drive flawless business operations that save time, money, and effort.

Workday Illuminate™.

Deliver measurable value with an AI platform that illuminates the future of work.

Forward thinkers. Inspiring results.

IT Solutions

Get—and stay—ahead with a flexible foundation.

Workday Illuminate™

Easily adopt AI with Illuminate—AI that lights the path forward.

Platform and Product Extensions

Enable organisational resilience and adaptability.

“We’ve taken the transformational impact of Workday even further. Our new Workday Extend app is driving huge efficiency gains in a highly complex operational process that is unique to our business.”

Elevate humans.

Free your people up to focus on more meaningful work that only humans can do.

Supercharge work.

Do more with less to drive flawless business operations that save time, money, and effort.

Workday Illuminate™.

Deliver measurable value with an AI platform that illuminates the future of work.

Legal Overview

Take control of your contract data and drive results across your organization.

Contract Lifecycle Management

Streamline workflows and automate your entire contracting process with AI.

Contract Intelligence

Leverage purpose-built AI to get total visibility into the agreements that fuel your organization.

“You can’t be a best-in-class legal department without introducing and becoming comfortable with AI technology. You just can’t do it.”